- Investing

- For Clients

- Promotions

- For Partners

- About us

Investment FAQ

- Why was the position closed at the price, which was not on the chart?Page issue

By default, the charts of investment instruments in the terminal show the Bid price, but not all positions are closed at this price.

Long positions (Buy) are opened at the Ask price and closed at the Bid price. Short positions (Sell), in their turn, are opened at the Bid price and closed at the Ask price.

As a result, on the chart you can see only the Bid price, at which your long (Buy) positions are closed.

It can be easily changed by enabling the Ask line in chart settings.

- Why was the order closed without my participation?Page issue

Your position could have been closed due to one of the following reasons:

- The margin level on your trading account reached the Stop Out value. (Current Stop Out values for each account type can be found on the ‘Account types’ page.)

- The asset price reached the Stop Loss or Take Profit level.

- The Trailing Stop for your position was triggered.

- How to open a position?Page issue

To open a position in a terminal window, right-click the selected tool and in the window which appears, choose "New order". After this you should set the parameters for the order and open the position by pressing the "Buy / Sell".

- Why was the order not executed at the declared price?Page issue

The following types of orders may be executed not at the declared price: Buy Stop, Sell Stop, and Stop Loss.

When these orders are triggered, the system sends the Market order, which is executed at the current price at the time of the order processing. This is the reason why there might be differences between the price specified in the pending order and the execution price.

Other types of pending orders, Buy Limit, Sell Limit, and Take Profit, are executed at the specified or better price, if such price exists on the market when they are executed.

- What is a credit line?Page issue

The credit line is a ratio between the investor’s own funds and borrowed funds. 1:100 credit line means that for a transaction you must have an account with amount 100 times less than the sum of the transaction.

Example: an investor chooses the 1:100 credit line and has 100 USD on his account. Credit line 1:100 allows him to buy a contract worth 100.000 USD. - What is a lot?Page issue

Lot is a unit of transactions in investment operations.

- How does the stop order work?Page issue

The Stop order is a trigger, and when it is reached, a corresponding order is generated.

There are Stop and Stop-Limit orders:

When the Stop order is activated, the Market order is generated.

When the Stop-Limit order is activated, the Limit order is generated.

The Stop order price is a trigger, and when it is reached, a corresponding order (market or Limit) will be generated.

- How is profit in currency market calculated?Page issue

Let’s suppose you purchased 1 lot EURUSD at 1.2291 and later closed the position at 1.2391. When opening the position, you bought 100,000 EUR, which is 1,2291 * 100,000 = 122,910 in USD. Basically, you acquired an asset worth 122,910 USD. When closing the position, you sold this asset worth 100,000 EUR, which, due to the price change, cost 123,910 USD (1,2391 * 100,000). Your profit will be 123,910-122,910 = 1,000 USD.

- How is a Swap calculated?Page issue

On the currency market, clients are charged with Rollover (Swap) charges for transiting the position over midnight. The amount of Swap depends on the difference between bank rates of the base currency and secondary currency in a currency pair. Swaps can have either positive or negative value.

RM Investment Bank swap rates are established in accordance with swap rates from our liquidity providers. Current swap rates for each investment instrument can be found in "Contract Specifications" section of our website.

- Why can I not sell at the weekend?Page issue

At weekends, the currency market is closed, just like other global stock exchanges.

- How risky are operations in currency market?Page issue

Investing in currencies, stocks, and other investment products is of the market nature and always involves significant risks. Because of sharp market fluctuations, you may both make much of your investments and completely lose them.

You may manage the risks (the ratio of possible financial losses to profits) by using the credit line value, and specific types of orders (Stop Loss / Take Profit) or other available tools. You should always remember that the higher the credit line and possible profit, the higher the risk level.

- What types of pending orders are there?Page issue

A pending order is the client's order to buy or sell a financial instrument at the specified price in the future.

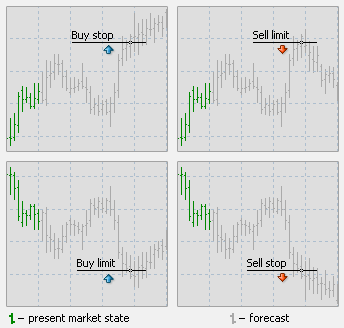

There are four types of pending orders:

Buy Limit — to buy, when the future "Ask" price is equal to the specified value. The current price level is higher than the value of the placed order. Execution of this type of order means that the transaction will be made at the price specified in the order or at the price that is lower. Orders of this type are usually placed in anticipation that the instrument price, having fallen to a certain level, will increase.

Buy Stop — to buy, when the future "Ask" price is equal to the specified value. The current price level is lower than the value of the placed order. Execution of this type of order means that the transaction will be made at the price existing at the moment when the order is executed, which may be different from the price specified in the order. Orders of this type are usually placed in anticipation that the instrument price, having reached a certain level, will keep increasing.

Sell Limit — to sell, when the future "Bid" price is equal to the specified value. The current price level is lower than the value of the placed order. Execution of this type of order means that the transaction will be made at the price specified in the order or at the price that is higher. Orders of this type are usually placed in anticipation that the instrument price, having rising to a certain level, will decrease.

Sell Stop — to sell, when the future "Bid" price is equal to the specified value. The current price level is higher than the value of the placed order. Execution of this type of order means that the transaction will be made at the price existing at the moment when the order is executed, which may be different from the price specified in the order. Orders of this type are usually placed in anticipation that the instrument price, having reached a certain level, will keep decreasing.

Ask

Our consultant will answer your question shortly.